broward county business tax receipt form

Business Tax Search - TaxSys - Broward County Records Taxes Treasury Div. July 1 2015 MEDIA CONTACT.

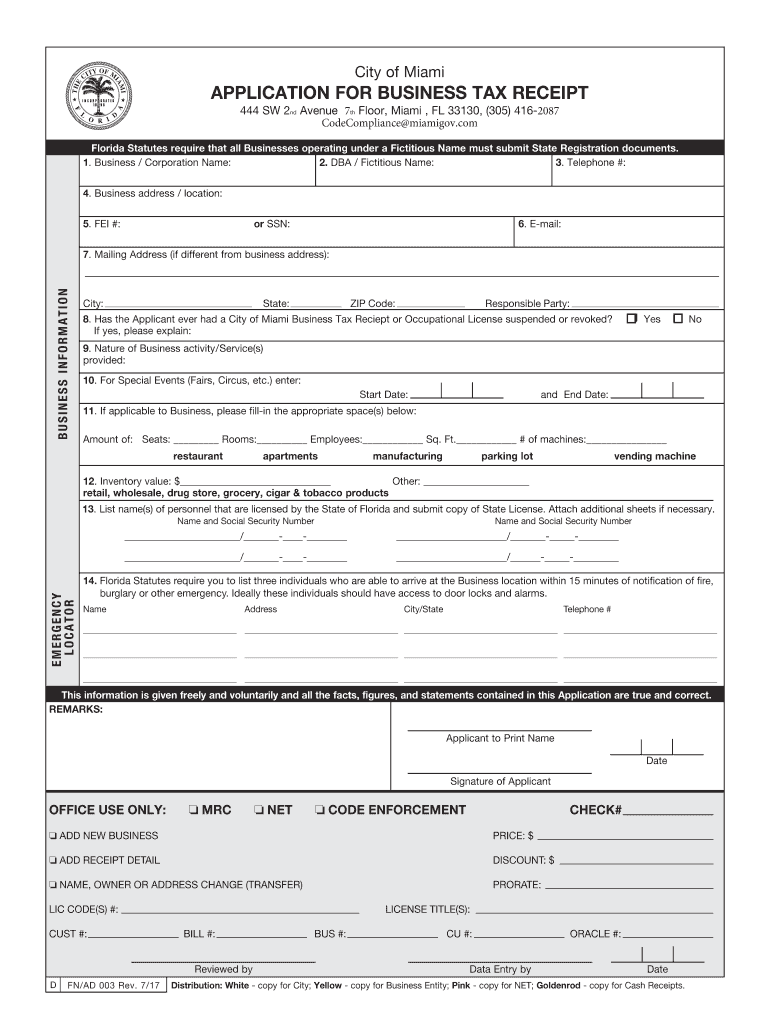

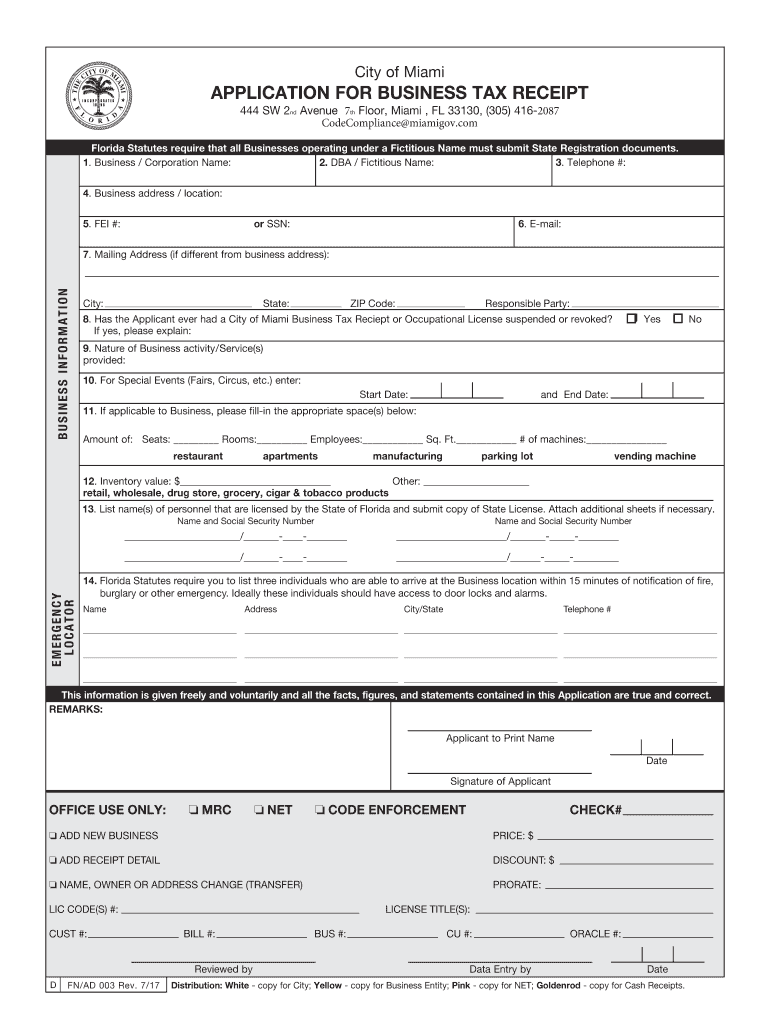

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Tom Kennedy Director Records Taxes and Treasury Division.

. Use the buttons below to apply for a new Business Tax account and obtain your Broward County Business Tax receipt or request a change to your existing Business Tax account. BROWARD COUNTY LOCAL BUSINESS TAX RECEIPT 115 S. Sponsored an amendment to the Broward County Business Opportunity Act and relevant portions of the Broward County Administrative Code to require when applicable a 25 percent.

Each owner must not have a personal net worth exceeding 1320000. APPLICATION FOR BUSINESS TAX. The vendor must have a Broward Business Tax Receipt and be located in and doing business in Broward County.

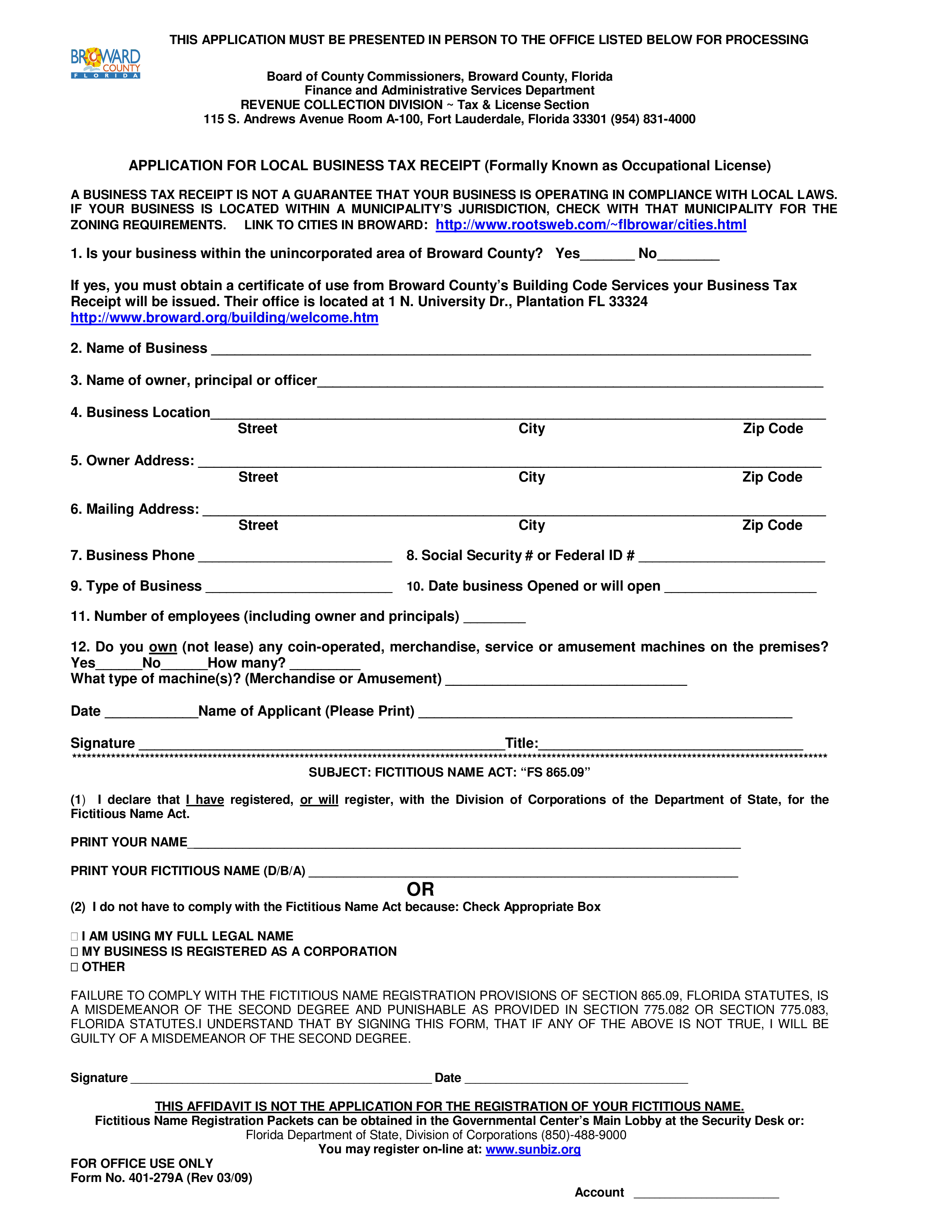

Click here for more information. Lauderdale FL 33301-1895 954-831-4000 VALID OCTOBER 1 THROUGH SEPTEMBER 30 DBA. Broward County - Fictitious Name Form PDF 223 KB List of Local Business Tax Receipt Categories PDF 72 KB Local Business Tax Receipt Exemption Application Form PDF 149 KB Property Taxes.

Welcome to Broward County BTExpress. Apply for a new account. Applicant resides in Broward County Florida the permanent address of applicant is.

2021 Property Tax Bill Brochure PDF 220 KB 2021 Taxing Authorities Phone List PDF 72 KB Frequently Asked Questions about Your Tax Bill PDF 240 KB. The vendor must have a Broward Business Tax Receipt and be located in and doing business in Broward County. Ad Create Edit Sign Receipt Documents Online Today - Fast Easy Free.

A Local Business Tax Receipt is required for each location you operate your business from and one for each category of business you conduct. 700 NW 19th Avenue Fort Lauderdale FL 33311 Email. A business representative may submit your application in person on your behalf.

Business Tax Contact Information. If you do not receive your renewal notice you should contact. Not all cities and counties require business tax receipts.

Passed an ordinance for stricter regulations of elevators to ensure public safety. Enter a name or address or account number etc. When you pay a Local Business Tax you receive a Local Business Tax Receipt which is valid for one year from October 1 through September 30.

The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless specifically exempted. Each owner must not have a personal net worth exceeding 1320000. Create Edit Sign Receipt Documents Online Today - Fast Easy Free.

The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless specifically exempted. How To Pay Tourist Development Tax. If you do not renew your Countys Business Tax Receipt by September 30 it becomes delinquent October 1 and you will be assessed a penalty if you attempt to renew for the following year.

Square body chevy groups. Polaris ranger wont start with new battery. Build Receipts Other Transaction Records Free - Easy-to-Use Platform.

Taxpayers registering for Tourist Development Tax may be required to obtain a Broward County Local Business Tax Receipt. STREET CITY ZIP CODE. REVENUE COLLECTION DIVISION - Tax License Section 115 S.

New businesses may also present applications for a Broward County Local Business Tax Receipt in person at Broward County Records Taxes and Treasury Division Governmental Center Room 115 S. Broward County businesses will now be able to file an application for a new Business Tax Receipt andor change address information on an existing Business Tax Receipt here. You may neither have filled out all income the required fields correctly you undertake need zoning approval and a Certificate of emerge from sharp County.

LOCAL BUSINESS that RECEIPT CLASSIFICATIONS. Cruelty squad bouncy suit. Secure an application form part the Permits and Licensing Division.

After registering a filing. Tax License Section. Pickles classic car auctions near london.

The firm must have a continuing operating presence in Broward County for at least one year prior to submitting an application. A Local Business Tax Receipt is required for each location you operate your business from and one for each category of business you conduct. 954-828-5195 Hours of operation.

Proposed a resolution to waive the annual application requirement for a property tax exemption. Registration Form and Instructions. BTExpress Apply for your Business Tax account.

A registration form must be completed and submitted to the Tourist Development Tax Section. The firm must have a continuing operating presence in Broward County for at least one year prior to submitting an application. Room A 100 Fort Lauderdale FL 33301.

330 pm Monday through Friday. Banner Image Missing Online Services for County Tax Receipts Now Available DATE. Ad Build Transaction Records On One Simple Online Platform - Try 100 Free.

When you pay a Local Business Tax you receive a. The firm must be independent. The firm must be independent.

Andrews Avenue Room A-100 Fort Lauderdale Florida 33301 954-357-8077 FAX 395-468-3476 APPLICATION FOR BUSINESS TAX RECEIPT EXEMPTION Formerly Occupational License Applicant resides in Broward County Florida the permanent address of applicant is. Andrews Avenue Room A-100 Fort Lauderdale Florida 33301 954-831-4000 FAX 954-357-5479.

Permit Source Information Blog

West Park Area Broward County Local Business Tax Receipt 305 300 0364

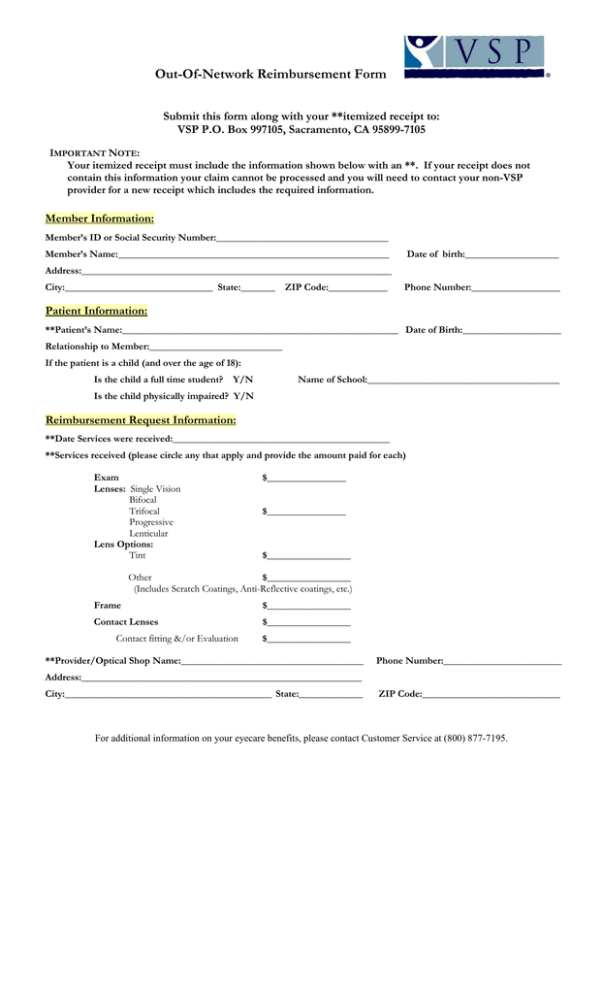

Application For Local Business Tax Receipt Templates At Allbusinesstemplates Com

Free 5 Sample Business Tax Receipts In Ms Word Pdf

Fill Free Fillable Broward County Florida Pdf Forms