kern county property tax due

Kern County is located in the US. Jails vital records property records tax collection public health and social services.

Asher Ranch By Frontier Communities In Rosamond California New Home Communities New Homes Home

The Kern County Museum is a federally recognized 501c3 non-profit organization.

. The exact property tax levied depends on the county in Illinois the property is located in. We offer volunteer opportunities and accept donations tax-deductible from local businesses and residents. On Friday December 10th 2021.

Property tax is calculated by multiplying the propertys assessed value by all the tax rates applicable to it and is an estimate of what an owner not benefiting of any exemptions would pay. Find more information below. The exact property tax levied depends on the county in Virginia the property is located in.

Illinois is ranked 5th of the 50 states for property taxes as a percentage of median income. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. In addition the County serves as the local.

That is nearly double the. The Riverside County Tax Collector offers the option to pay property tax payments online and by automated phone call. Virginia is ranked 29th of the 50 states for property taxes as a percentage of median income.

Payments can be made on this website or mailed to our payment processing center at PO. Consider becoming an annual member of the Museum. Lake County collects the highest property tax in Illinois levying an average of 219 of median home value yearly in property taxes while Hardin County has.

Kern County Treasurer and Tax Collector said that the first installment of Kern County property tax will become delinquent if not paid by 5 pm. Box 541004 Los Angeles CA 90054-1004. The property tax rate in the county is 078.

The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 45000 or less among other requirements. The Tax Collectors Office accepts payment by credit card at a 228 convenience fee and by debit card for a 395 flat fee. Settlers considered the flat land of the valley inhospitable and impassable at the time due to swamps lakes tule reeds and diseases such as malaria.

The tax rates are expressed as dollars per 100 of assessed value therefore the tax amount is already divided by 100 in order to obtain the correct value. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Falls Church city collects the highest property tax in Virginia levying an average of 094 of median home value yearly in property taxes while Buchanan.

Kern County Treasurer And Tax Collector

5 01 Acre Lot In Kern County California Minutes Away From The City Google Earth Kern County Text

See The Direction To 5 Acres Yucca Valley Property In San Bernardino Ca In 2021 Riverside County San Bernardino County Desert Hot Springs

Vita United Way Of Kern County

Kern County Water Agency Water For The People By Josh Jason Juy Ppt Download

Kern County Ca 2021 Tax Sale Over 1 500 Properties Deal Of The Week Youtube

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

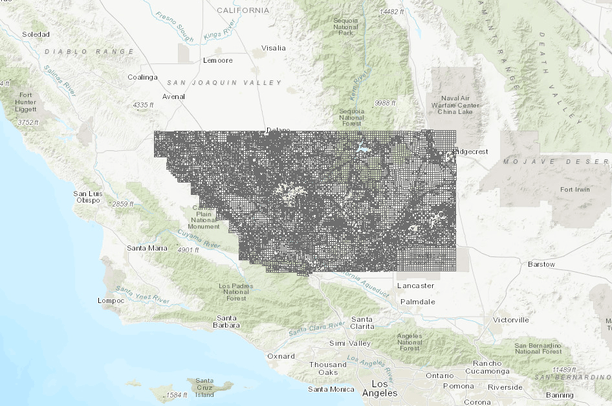

Parcels 2019 Kern County Data Basin

Kern County Treasurer And Tax Collector

About The Grand Jury Kern County Ca

California Public Records Public Records California Records

Sherrie Friday Knight Owner Kern Tax Service Linkedin

New Homes For Sale In Rosamond California Your Dream New Home In Rosamond 3 Broker Co Op 3 Exciti New Homes For Sale California Modern Finding A House